The FDA issued guidance on April 10, 2025 to phase out animal trials in favor of organoids and organ-on-a-chip systems. Less than three weeks later, the NIH inaugurated the Office of Research Innovation, Validation, and Application (ORIVA) on April 29th. And in September, the NIH announced $87 million in contracts over three years to launch the Standardized Organoid Modeling (SOM) Center at Frederick National Laboratory.

These weren’t incremental policy updates. They were institutional declarations: organoids are no longer experimental. They’re infrastructure. For those working in the field, 2025 felt less like a year of breakthroughs and more like a year of reckoning – when years of technical progress collided with the operational reality of making organoids work at scale.

Organoids 2025: A year in review

The regulatory landscape shifted in ways that were both concrete and subtle.

The U.S. Senate passed the FDA Modernization Act 3.0 on December 16 by unanimous consent, directing the FDA to update its regulations within twelve months to align with the 2022 law that removed mandatory animal testing. The bill arrived after FDA Commissioner Martin Makary had already announced in April 2025 a plan to reduce animal testing, initially focusing on monoclonal antibodies.

The NIH’s SOM Center represents something more tangible. It will initially focus on organoid models of the liver, lung, heart, and intestine, with plans to expand into brain, thymus, and other disease-specific models. The center will provide open access to protocols, data, and physical organoid samples – not just to academics, but to industry partners and regulatory agencies seeking human-relevant models for safety assessments.

This matters because standardization has been organoid research’s persistent bottleneck. Every lab had its own protocols. Cross-site reproducibility was inconsistent. Now there’s federal infrastructure dedicated to solving that problem.

The consolidation signal

While regulators were building frameworks, industry was consolidating expertise.

In December 2024, Merck KGaA (operating as MilliporeSigma in the U.S.) acquired HUB Organoids B.V., the deal closing on December 23. HUB, based in Utrecht with about 70 employees, holds foundational patents on organoid technology and offers services from model generation to high-throughput screening.

This acquisition signals a shift. When major life science suppliers buy specialized organoid companies, they’re betting that organoids will become standard reagents – not boutique research tools. HUB’s technology enables drug developers to identify and validate potential clinical candidates in patient-relevant in vitro systems, closing the gap between lab and clinical trials.

In Asia, a different kind of consolidation was happening. OrganoidSciences, a South Korean biotech company, debuted on the Seoul bourse (KOSDAQ) on May 9, 2025, with its share price surging 52.38% on the first day. Founded in 2018 by CEO Jongman Yoo, the company has been recognized by the South Korean Ministry of Trade, Industry and Energy as possessing ‘National Advanced Strategic Technology’ – a designation for companies developing technologies with significant national economic benefits.

The company’s European expansion through its strategic partner Lambda Biologics GmbH in Leipzig, Germany, reflects a calculated approach to global growth. Backed by public funding from the European Union and the government of the Free State of Saxony, Lambda Biologics serves as a connector in the shift toward validated alternatives to animal testing. The partnership allows OrganoidSciences to access European markets while Lambda Biologics gains access to advanced organoid production methods for clinical-grade manufacturing.

In May 2025, Vivodyne announced $40 million in investment, reflecting continued venture interest despite a challenging biotech funding environment. The company, founded by bioengineer Dan Huh, is combining robotics and AI with organ-on-chip systems for preclinical drug development.

The pattern is clear: established suppliers are acquiring organoid expertise, while specialized organoid companies are going public or securing significant funding to scale operations and expand internationally.

Where clinical evidence emerged

The most significant clinical data came not from dramatic breakthroughs, but from careful validation studies.

The PASS-01 trial results, published September 10, 2025 in the Journal of Clinical Oncology, showed what’s possible when comprehensive molecular profiling meets patient-derived organoid (PDO) drug sensitivity testing. The trial compared two standard chemotherapy regimens in 160 advanced pancreatic cancer patients across six sites in the U.S. and Canada.

The study revealed two distinct subtypes – basal-like and classical pancreatic cancer. Patients with basal-like tumors responded poorly overall but fared best with gemcitabine plus nab-paclitaxel. More importantly, the trial demonstrated that PDOs could be integrated into real-time clinical decision-making through Molecular Tumor Board meetings.

In colorectal cancer, a 2023 trial involving advanced gastric cancer patients showed 87% concordance between organoid drug sensitivity testing and actual clinical responses. Similar validation studies continued throughout 2025 across multiple cancer types.

But the field also confronted limitations. A systematic review found surprisingly no randomized controlled trials have reported clinical outcomes with any types of organoids. Several trials are ongoing, planning to recruit between 93 and 200 patients, with results expected over the next 2-10 years.

The gap between preclinical promise and clinical validation remains real.

The IVF pregnancy modeling breakthrough

One of the year’s most striking developments came in reproductive medicine.

In December 2025, three papers published by Cell Press reported the most accurate efforts yet to mimic the first moments of pregnancy in the lab. Researchers took human embryos from IVF centers and merged them with endometrial organoids grown from uterine lining cells.

Two startup companies – Dawn Bio in Vienna and Simbryo Technologies in Houston – have raised funds to commercialize these systems, with Simbryo beginning to offer “personalized” predictions for IVF patients.

The approach could help explain why IVF fails when embryos don’t implant. Doctors can take a biopsy of a patient’s uterine lining, grow organoids, add blastoids (artificial embryos), and assess whether the uterus is receptive. If blastoids don’t implant in the organoid system, it could indicate the patient’s uterus isn’t receptive .

This represents a new category of organoid application – not drug testing or disease modeling, but functional prediction of biological compatibility.

What the market numbers suggest

According to The Insight Partners, the organoid market is expected to reach $15.01 billion in 2031, up from $3.03 billion in 2023 – a CAGR of 22.1%.

There are now 102+ organoid research model startups globally, with 72 funded and 20 having secured Series A+ funding. The United States has the most companies (35), followed by China (7) and the United Kingdom (7).

But market size projections don’t tell the full story. The field’s maturation is visible in where companies are focusing: less on proving organoids work, more on making them reproducible, scalable, and economically viable for specific applications.

The operational challenges that persisted

Despite progress, 2025 reinforced that organoid technology’s biggest barriers aren’t scientific – they’re operational.

Reproducibility gaps: Charles River Laboratories reported using organoid models to investigate why three drug candidates failed in clinical trials. One drug showed significantly higher toxicity in gut organoids, while another had reduced efficacy and unexpected toxicity – both aligning with human trial failures. A third compound appeared effective in cell lines and animal studies, but organoid analysis revealed it only temporarily blocked viral replication rather than eliminating the virus – a distinction missed in preclinical testing.

These successes came from a company with deep expertise and resources. Many academic labs still struggle with batch-to-batch variability.

Culture success rates: Recent reports indicate the success rate of cultivating organoids for hepatobiliary and pancreatic cancers consistently exceeds 70%, with predictive accuracy shown to surpass 90%. But success rates vary significantly by tissue type and disease state. Organoids are more challenging to produce from tumors with MSI, BRAF mutations, hypodifferentiation, and mucinous phenotypes.

Timeline constraints: Patient-derived organoids can take weeks to establish. For personalized medicine applications where patients need treatment decisions quickly, this timeline can be prohibitive.

Cost-effectiveness: The economic model remains challenging outside of oncology. For high-throughput screening applications, teams are still determining when organoid data justifies the additional cost over 2D cultures.

Geographic developments

The International Society of Organoid Research (ISoOR) held its 2025 annual meeting on March 7-8 in Shanghai, reflecting China’s rapid expansion of the organoid industry. The conference attracted over a thousand attendees, building on the momentum from 2024.

Asia’s growing role in organoid research reflects both regulatory interest and commercial investment, particularly in regenerative medicine applications. OrganoidSciences, based in South Korea, has developed advanced production methods for clinical-grade organoid manufacturing, focusing on tissue-specific stem cells for regenerative purposes. The company expanded globally through its German strategic partner, Lambda Biologics GmbH.

Europe continued to be a center of innovation, particularly in the Netherlands (HUB Organoids) and Germany, where EU funding supports alternatives to animal testing.

What 2025 taught the field

The year clarified several realities:

Hybrid approaches are the norm: Very few teams replaced animal models or 2D cultures entirely. The most sophisticated drug development programs built decision trees – using organoids for human-specific questions, animals for systemic effects, and 2D cultures for initial screening. The question shifted from “organoids versus animals” to “organoids for what?”

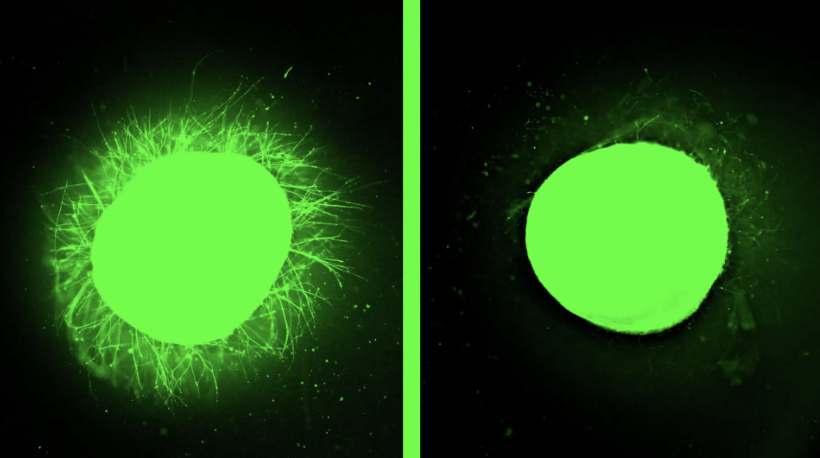

Context matters more than structure: Early organoid papers emphasized morphology – does it look like an organ? By 2025, the emphasis was decisively on function. Does it metabolize drugs like a liver? Does it respond to injury like an intestine? Teams learned that structure without validated function isn’t enough.

Standardization is infrastructure work: The field needs what antibody validation achieved years ago – not rigid protocols, but documented methods with defined acceptable ranges. The NIH’s SOM Center is attempting this, but it will take years to develop consensus across tissue types and applications.

Clinical validation takes time: Despite growing commercial interest and regulatory support, robust clinical validation studies are just beginning. The field has moved past proof-of-concept, but evidence that organoid-guided treatment improves patient outcomes remains limited to specific cancer types.

What didn’t happen

It’s worth noting what 2025 wasn’t.

No major pharma company announced that organoids had replaced animal studies for an entire drug program. No regulatory agency approved organoid testing as a standalone requirement for IND submission. No clinical trial demonstrated that organoid-guided therapy significantly outperformed standard of care across a broad patient population.

The year wasn’t about dramatic breakthroughs. It was about infrastructure – regulatory frameworks, standardization efforts, commercial consolidation, and incremental clinical validation.

Looking at 2026

As we enter 2026, the organoid field faces a different set of challenges than it did five years ago.

The technology works. The question is: for which specific applications does it work well enough to change decisions, and how do we make it reproducible and economically viable at scale?

The NIH’s SOM Center will release its first standardized protocols. Clinical trials using organoid-guided treatment selection will report results. The FDA Modernization Act 3.0, if enacted, will require regulatory updates within twelve months.

Progress will be measured in protocol adoption rates, cross-site reproducibility metrics, and clinical validation data – not in the number of new organoid papers published.

The excitement of the early years, when every new organoid type felt like a breakthrough, has given way to something more valuable: the hard work of making a proven technology actually usable.

That’s not less important than breakthroughs. For a field aiming to change how drugs are developed and diseases are understood, it might be more important.

2025 was the year organoids stopped being a vision and started becoming infrastructure. What happens next depends on whether the field can deliver on that promise.

Read more:

Unlocking Human Insight with Organoid Models

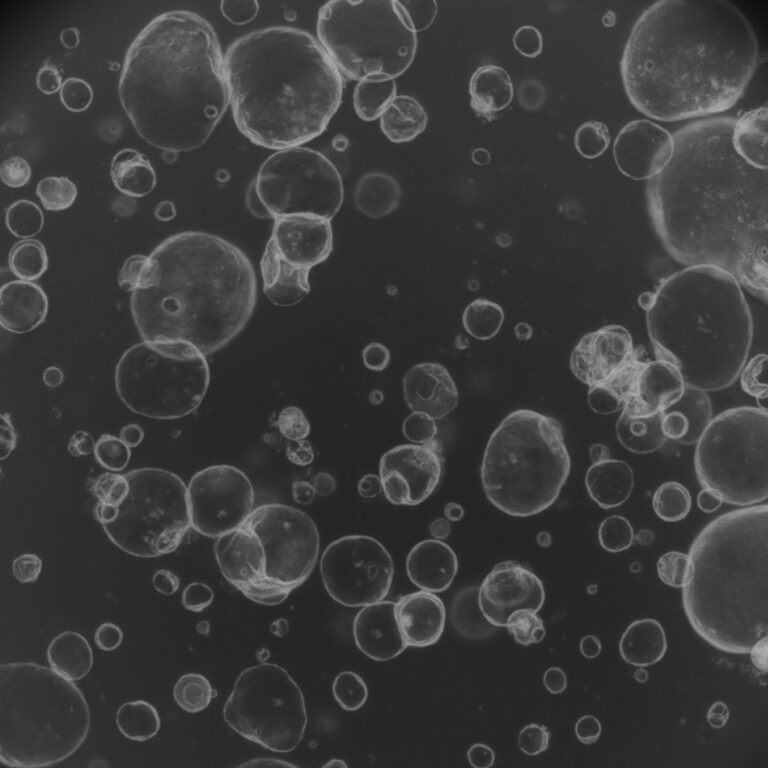

Lambda Biologics provides advanced organoid technology and services for biomedical research and drug development. We specialize in physiologically relevant 3D organoid models that bridge the gap between traditional cell cultures and animal models.

Our comprehensive solutions span disease modeling, drug screening, personalized medicine, and regulatory-compliant testing – supporting pharmaceutical companies, biotech firms, academic institutions, and cosmetics manufacturers worldwide.

Cerebral Organoid | Midbrain Organoid | Skin & Hair Organoid | Intestine Organoid | Gastric Cancer Organoid | Breast Cancer Organoid | Hepatocarcinoma Cancer Organoid | Pancreatic Cancer Organoid